|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

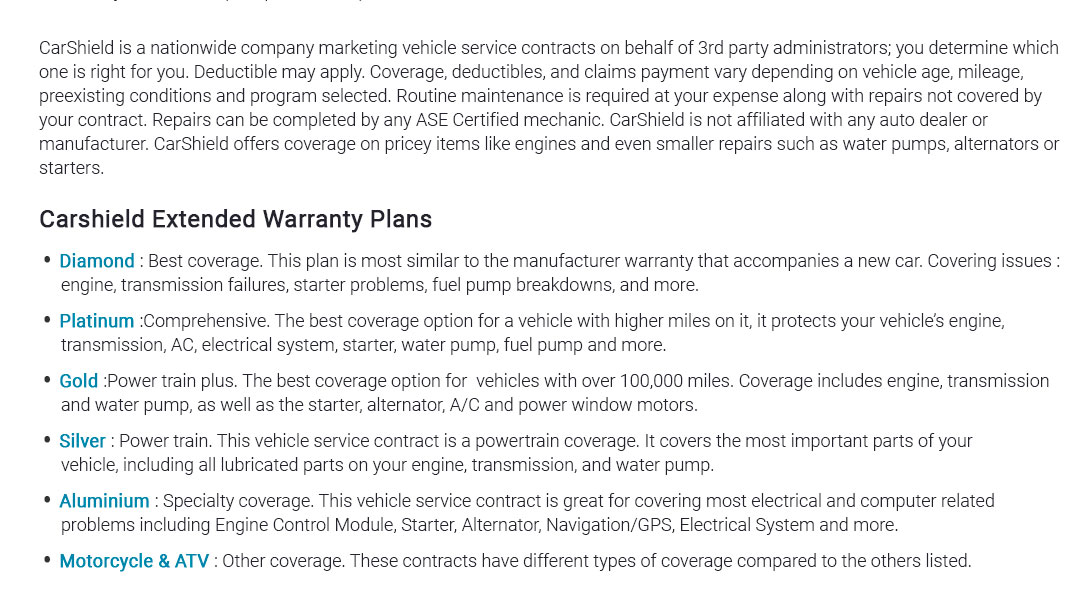

auto repair insurance coverage with clear tradeoffs and real-world resultsAuto repair insurance coverage - often called mechanical breakdown protection - helps pay for parts and labor after a covered failure. It is not collision, liability, or routine maintenance. The relevance is immediate: it can turn a surprise bill into a planned cost. What typically is and isn't coveredTerms vary, but patterns are consistent.

Real-world moment: on a cold Tuesday, your alternator dies at 62,000 miles. The shop quotes $980. You call the provider before authorizing work; after approval, you pay a $100 deductible and the rest is covered - though the rental allowance tops out at $35/day. Cost versus value

Comprehensive plans sound safest. Not quite; many still exclude wear-and-tear and cap labor. The result you want is predictable expenses, not promises. How to choose

Bottom lineIf you run high miles or keep cars 6 - 8 years, a plan can stabilize cash flow. If you keep a solid emergency fund - and your model is historically reliable - skipping coverage may be the more efficient choice while you monitor service bulletins. https://www.lemonade.com/car/explained/car-repair-insurance/

Probably Covered: Typically, car repair coverage covers all repairs that aren't specifically excluded from the policy. That means if you're unable to shift your ... https://www.progressivecommercial.com/business-insurance/professions/auto-mechanic-insurance/

Auto mechanic insurance is designed to protect auto repair shop mechanics and mobile mechanics from costly liabilities resulting from unexpected accidents. https://www.libertymutual.com/vehicle/auto-insurance/coverage/car-repair-insurance

What is the Lifetime Repair Guarantee? The Lifetime Repair Guarantee is a car repair insurance that eliminates the hassle of fixing your car after an accident.

|